Saving money might appear basic in hypothesis, but in hone, numerous individuals battle to adhere to a arrange. The key isn’t fair cutting expenses—it’s making a reserve funds arrange that fits your way of life, objectives, and money related propensities.

This direct will offer assistance you construct a investment funds arrange that really works, turning great eagerly into unmistakable monetary progress.

1. Get it Your Budgetary Picture

Before making a investment funds arrange, you require a clear see of your accounts. This means:

- Tracking salary: Know precisely how much cash comes in each month.

- Listing costs: Categorize your investing into basics (lease, bills, goods) and non-essentials (memberships, feasting out).

- Identifying obligation: Get it any advances or credit card equalizations to figure them into your plan.

Tools like budgeting apps or spreadsheets can make this step less demanding and more accurate.

2. Set Clear, Achievable Goals

A reserve funds arrange works best when it’s goal-oriented. Objectives allow your arrange course and inspiration. Consider:

- Short-term objectives: Crisis support, excursion support, or sparing for a modern gadget.

- Medium-term objectives: Down installment for a domestic, car buy, or education.

- Long-term objectives: Retirement, children’s instruction, or monetary independence.

Be particular approximately your objectives. Instep of “save money,” point for “save $5,000 in 12 months.”

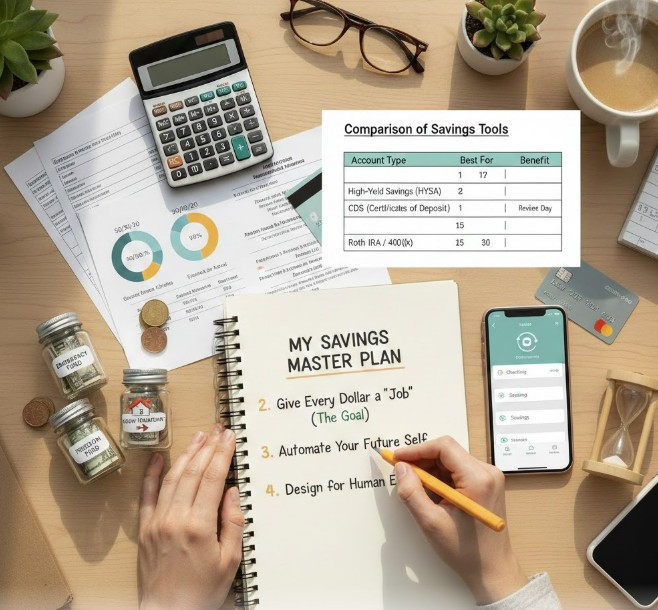

3. Select the Right Reserve funds Strategy

Not all investment funds strategies are made break even with. Depending on your objectives, consider:

- Automatic exchanges: Plan a parcel of your pay to go straightforwardly into reserve funds accounts.

- 50/30/20 run the show: Designate 50% for needs, 30% for needs, and 20% for investment funds or obligation repayment.

- High-yield accounts: Utilize investment funds accounts with higher intrigued rates to develop your cash faster.

- Cash envelopes: For individuals who overspend on optional things, isolating cash into envelopes can constrain spending.

The best technique is one you can keep up consistently.

4. Construct an Crisis Finance First

An crisis support acts as a money related security net, avoiding you from plunging into your reserve funds for unforeseen costs like restorative bills or car repairs.

- Aim for 3–6 months’ worth of fundamental expenses.

- Keep this finance in a isolated, effectively available account.

Once your crisis finance is secure, you can center on other reserve funds objectives with confidence.

5. Track and Alter Regularly

A investment funds arrange isn’t “set and forget.” Frequently checking on your arrange guarantees it remains adjusted with your life:

- Monthly audit: Check your advance and alter commitments if needed.

- Celebrate breakthroughs: Compensate yourself for coming to objectives to remain motivated.

- Adjust for life changes: Salary changes, modern costs, or money related objectives ought to reflect in your plan.

6. Minimize Superfluous Expenses

Cutting little, avoidable costs can free up additional cash for savings:

- Cancel unused subscriptions.

- Cook dinners at domestic instep of eating out frequently.

- Compare protections, utility, and benefit suppliers for superior rates.

Even unassuming diminishments can have a noteworthy affect over time.

7. Remain Accountable

Accountability boosts victory. Consider:

- Sharing your objectives with a accomplice, companion, or monetary advisor.

- Joining online communities centered on sparing money.

- Using apps that track your advance and send reminders.

8. Make Sparing Automatic

The less demanding you make sparing, the more likely you are to adhere to it. Automate:

- Payroll conclusions to investment funds accounts.

- Bill installments to dodge late fees.

- Investments into retirement accounts.

Automation evacuates the enticement to spend what you expected to save.

Final Thoughts

A investment funds arrange as it were works if it’s practical, adaptable, and goal-driven. Begin by understanding your funds, set particular objectives, and computerize your reserve funds. Frequently survey and alter your arrange, minimize pointless costs, and remain responsible. With consistency and teach, you can turn sparing from a battle into a habit—and secure your money related future.