Investing can feel overpowering for tenderfoots. With endless choices, showcase changes, and money related language, it’s simple to get misplaced. Be that as it may, making a strong contributing outline early can offer assistance you develop riches securely and consistently over time. This direct will offer assistance you explore the nuts and bolts and construct a technique custom-made for long-term budgetary success.

1. Get it the Significance of Investing

Before plunging into particular venture choices, it’s vital to get it why contributing things. Not at all like sparing, which ordinarily offers negligible returns, contributing permits your cash to develop through compounding. Over time, indeed little, reliable speculations can develop essentially, making a difference you accomplish objectives like buying a domestic, financing instruction, or getting a charge out of a comfortable retirement.

Key Takeaway: Contributing isn’t fair approximately making cash; it’s almost making your cash work for you.

2. Set Clear Monetary Goals

Every fruitful speculation technique begins with clear destinations. Inquire yourself:

- Are you contributing for short-term objectives (1–5 a long time) or long-term objectives (10+ years)?

- What level of hazard are you comfortable with?

- How much capital can you reliably invest?

Having characterized objectives makes a difference you select the right venture sorts and keep up teach amid advertise fluctuations.

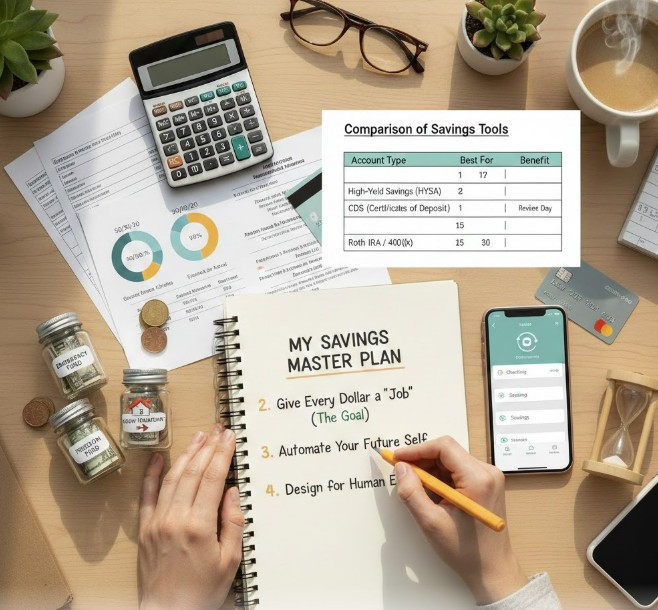

3. Construct a Security Net First

Before contributing, guarantee you have an crisis support. Monetary specialists prescribe sparing 3–6 months of living costs in a fluid, low-risk account. This guarantees that unforeseen costs won’t constrain you to offer ventures at a loss.

Tip: Think of your crisis finance as the security saddle that lets you contribute unquestionably without panic.

4. Select Beginner-Friendly Venture Options

For fledglings, the objective is to develop riches securely and relentlessly. Here are a few beginner-friendly options:

- High-Yield Reserve funds Accounts (HYSA): Offers way better intrigued than conventional investment funds, perfect for short-term goals.

- Certificates of Store (CDs): Secure, settled returns for a set period.

- Index Stores & ETFs: Differentiated ventures that track the advertise. Lower chance than person stocks.

- Blue-Chip Stocks: Built up companies with steady performance.

- Robo-Advisors: Mechanized stages that make and oversee portfolios based on your hazard profile.

SEO Tip: Utilizing terms like secure speculations for tenderfoots and how to begin contributing for consistent returns makes a difference draw in high-value traffic.

5. Expand Your Portfolio

Diversification diminishes hazard by spreading ventures over numerous resource classes. Don’t put all your eggs in one basket:

- Mix stocks, bonds, and cash-equivalents.

- Consider universal introduction to tap into worldwide growth.

- Rebalance yearly to keep up your craved hazard level.

Pro Tip: Expansion is your best instrument for unfaltering development and peace of mind.

6. Embrace a Long-Term Mindset

The most fruitful financial specialists prioritize tolerance. Advertise plunges and short-term instability are ordinary, but long-term financial specialists regularly procure the rewards.

- Avoid enthusiastic exchanging based on every day advertise news.

- Focus on the control of compounding interest.

- Consistently contribute, indeed little sums, over time.

Insight: Time in the showcase beats timing the market.

7. Robotize and Screen Your Investments

Automation guarantees consistency and teach. Set up programmed commitments to your speculation accounts month to month. This “pay yourself to begin with” approach makes a difference you adhere to your arrange without depending on memory or willpower.

Additionally, screen your portfolio at slightest quarterly:

- Track execution against your goals.

- Adjust resource assignment if necessary.

- Stay educated approximately financial changes that may affect your investments.

8. Keep Learning and Adjusting

Investing is a deep rooted learning handle. Tenderfoots ought to center on understanding essential concepts like chance resilience, resource allotment, and compounding. Assets like venture blogs, podcasts, and online courses can offer assistance extend your knowledge.

Tip: Dodge get-rich-quick plans and center on feasible, consistent growth.

9. Tax-Efficient Strategies

Taxes can eat into your speculation returns if not overseen legitimately. Consider:

- Contributing to tax-advantaged accounts like IRAs or 401(k)s.

- Holding speculations for the long term to decrease capital picks up tax.

- Consulting a assess advisor for personalized strategies.

A small arranging can essentially boost your net returns over time.

10. Key Takeaways for Tenderfoot Investors

- Start with clear objectives and a solid crisis fund.

- Focus on secure, broadened venture options.

- Automate commitments and screen performance.

- Maintain a long-term mindset.

- Keep learning and alter methodologies as needed.

Investing doesn’t have to be complicated. With persistence, teach, and a clear outline, fledglings can develop riches relentlessly and securely.